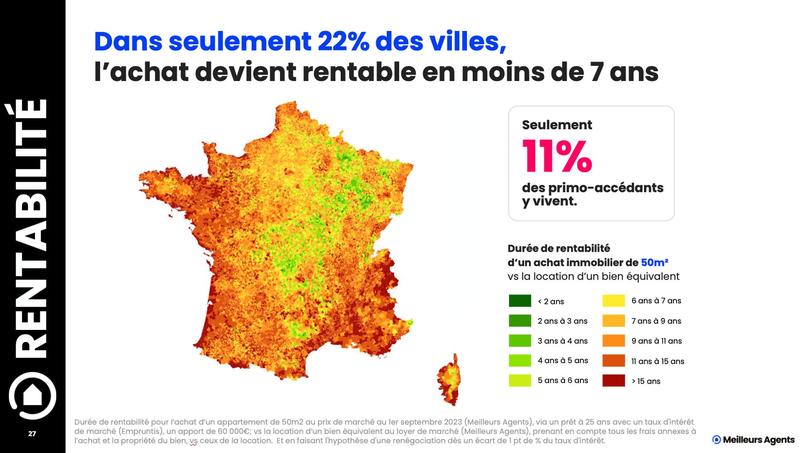

Usually, the French often start by buying a two-room apartment and then another room, for example, for childbirth. But that was before. The rise in loan rates has completely turned this residential journey upside down. Buying a first house with an area of 50 m² is not necessarily worthwhile for young households. And above all, not necessarily the possible future needs of the engaged couple. Sure, 90% of first-time buyers have the capacity to buy a 50m² flat, but according to a study by Meilleurs Agents, a property valuation website, they will have to wait almost 12 years to make their purchase profitable. In other words, to build assets at least equivalent to the savings they would have accumulated if they had remained a renter.

The profitability of the purchase is not necessarily a priority for households before acquiring housing – but rather for housing – but it can be useful to avoid the need to multiply purchases and therefore costs – (agency, notary). In just two years, the time to profitability multiplied by 8! It’s even longer because the French stay in their property for an average of 7 years before selling it. “If you are a couple, buying a 50 m² apartment means that you are not planning to have children right away, unless you decide to live as a group of 3 on 50 m²», deciphers Thomas Lefebvre, scientific director of Meilleurs Agents.

Bear cycle after 2024

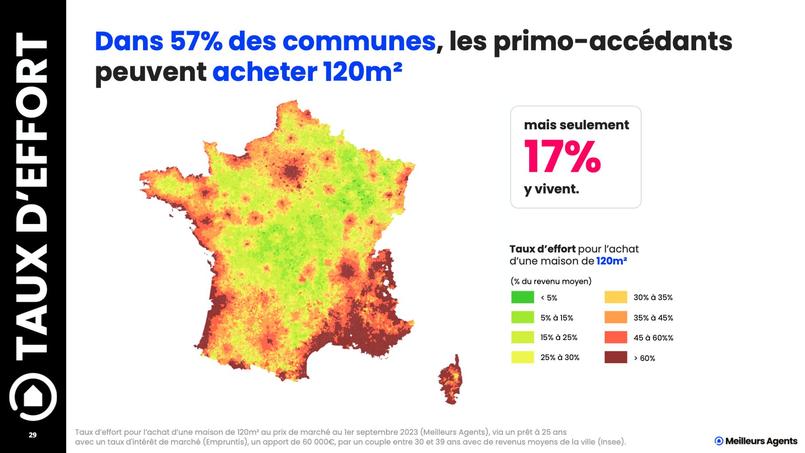

So, in the event that a couple is expecting a happy event, wouldn’t it be more sensible to skip the “two-room” stage and get a larger accommodation? Not necessarily. This type of acquisition – very popular with households during the health crisis – may certainly be suitable for households wanting space, but only 57% of France’s 36,000 communes are accessible to first-time buyers. Worse: only 17% of those buyers live there. To shorten the period of profitability, the young workers have two solutions: negotiate a 30% reduction in the selling price or double their personal contribution. If you don’t deal with the seller in a hurry, have savings in reserve – both of which seem unlikely at the moment – or don’t use the helping hand of family – which isn’t available to everyone – first-time buyers risk being condemned to remain renters.

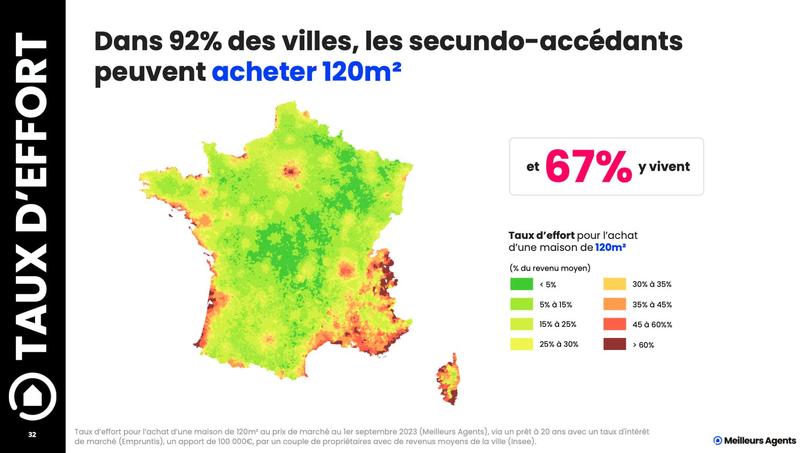

What about second-time buyers, i.e. those who have already bought their first property? The situation is more favorable. Since they are already owners, they can count on the sale of their home to increase their contribution. In addition, buying a bigger house fits their life plan, even though the average payback period for buying a property is also around 12 years. “As long as prices remain at these high levels, the market will primarily be driven by second-time buyers. That means at least until September 2024 or probably longer», predicts Thomas Lefebvre, who expects prices to fall by 4% within a year and household purchasing power to fall by 12% despite rising incomes. But according to this real estate expert, “the drop in prices is still not enough to equalize lending rates» which should remain stable at around 4% until autumn 2024.