Posted on December 29, 2023 at 5:41 pmUpdated December 29, 2023 at 6:09 p.m.

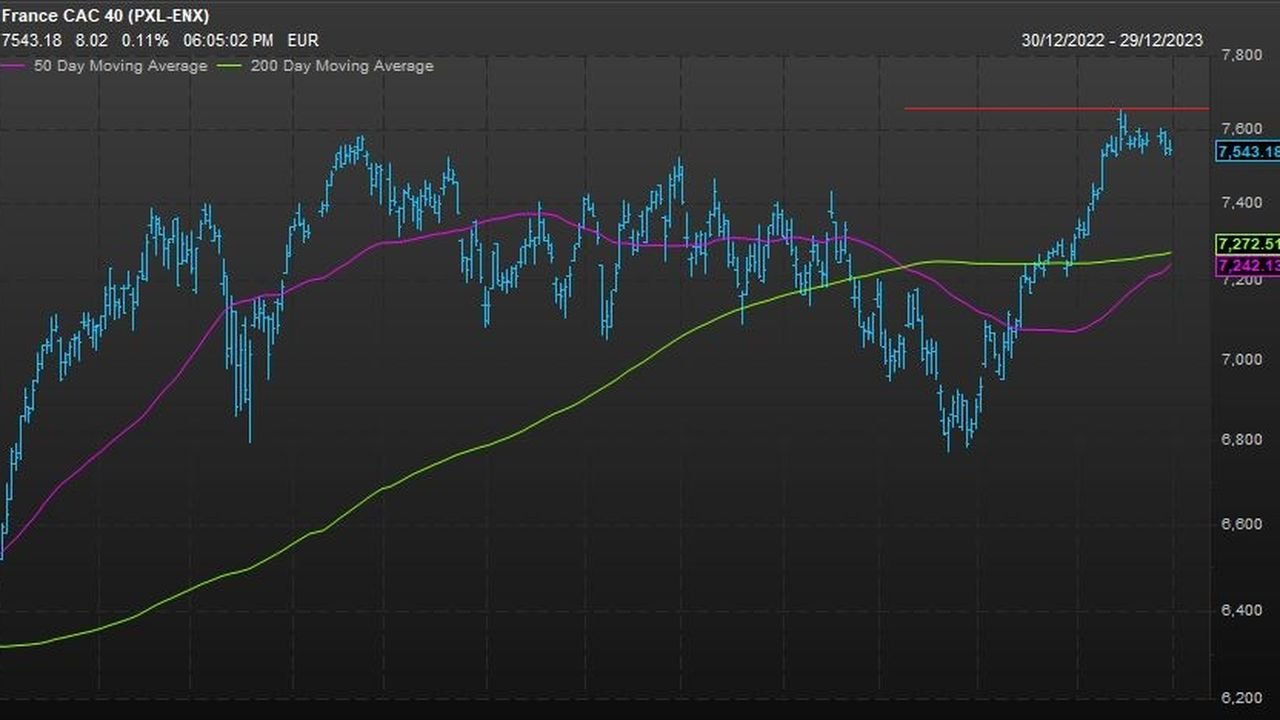

This year 2023 has come to an end in the stock market and the results are very noticeable for the Cac 40, which has gained some 16.52% in the full twelve months (+0.11% to 7,543, 18 points this Friday). This is the flagship index’s third best performance in the last ten years. Only 2021 (+28.85%) and 2019 (+26.37%) have done better since 2014.

2023 will also be an excellent year globally for the Paris Stock Exchange, outperforming the Dow Jones (+13.4% this Friday at the end of the day, a few hours before US markets closed) but certainly underperforming the S&P 500 (+23 .9%) and above all than the Nasdaq Composite (+42.9%), both fueled by the “Magnificent 7” years and the craze for AI stocks, with Nvidia leading the way (+238%).

Monetary policy as a “mover”

In Asia, it was the Nikkei that posted the region’s biggest annual gain, up 28%, the first for the Japanese index since 2013, the year Haruhiko Kuroda took office as Bank of Japan governor and began massive monetary easing. . Conversely, the CSI of the Shanghai and Shenzhen bourses fell 11.4% in 2023, the third consecutive year of decline, on the back of China’s slow post-Covid economic recovery.

The main “driving force” of this stock year was monetary policy. While operators initially waited for a long time for signs of the end of the monetary policy tightening cycle, from the European Central Bank, but above all from the US Federal Reserve Bank, given its positive results in the fight against inflation, they were then excited by the prospect of the first easing movements in 2024, with the most optimistic banking on the Fed’s gesture as early as March. Especially since this is a “soft landing” scenario most favorable to the stock market holding the rope.

History shows that the US economy has only rarely escaped recession after a cycle of monetary tightening by the Federal Reserve. The most commonly cited example is the interest rate hike in just over a year from 3% to 6% in March 1995. The US economy then slowed without entering a recession. , gross domestic product growth did not fall below 2.2% in one year at the end of 1995.

14 entries within Cac 40

However, 2023 will not be a long and quiet river for the Cac 40 companies. We thus remember the 59% collapse of payment solutions group Worldline during the session on October 25, the biggest decline ever recorded by a company in a single day in the history of the index, on the back of a revision of growth and margin targets for a given year along with abandoning medium-term forecasts. Alstom plunged 37% in a single day after announcing that its free cash flow would be between €500 million and €750 million negative at the end of the financial year ending in late March, against its original “free cash flow” target significantly positive “. Call center manager Teleperformance lost another 41% after its 43% setback already suffered in 2022.

In terms of good performances, it was carmaker Stellantis that came out on top with a gain of 59% for the year. Saint-Gobain and Publicis follow with more than 40% growth. Overall, it was the visibility and solidity of margins and order books that investors praised. 14 companies in the index thus set new all-time records: Stellantis, Publicis, Hermès, L’Oréal, Airbus, Safran, Air Liquide, Schneider Electric and Vinci during the month of December, at the same time as the Cac 40 recorded a new peak at 7,653.99 point on the 14th day of the month. Earlier this year, four other shares in the index hit new all-time highs: LVMH, the undisputed market capitalization leader, and Pernod Ricard in April, Edenred in June, Thales in October and TotalEnergies in November.