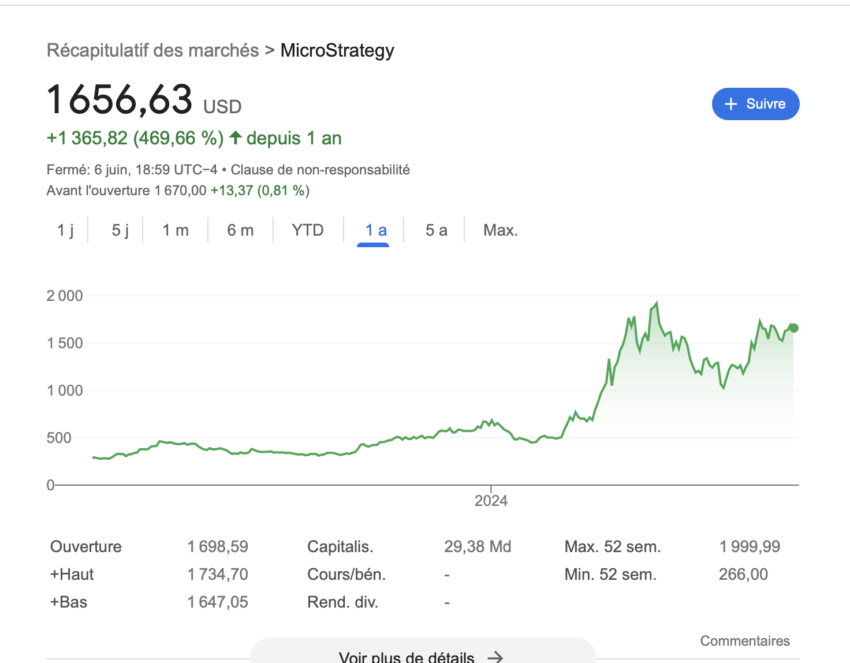

MicroStrategy’s strong stock market growth over the past 12 months doesn’t seem to be pleasing everyone. Indeed, between June 2023 and June 2024, the Business Intelligence firm’s stock increased in value by 470%, the best performance among crypto and pro-crypto stocks on Wall Street.

However, this MSTR uptrend may come to a halt as many hedge funds on Wall Street are betting heavily on the stock falling. MicroStrategy has at least 18 short positions against its stock valued at nearly $6.9 billion, according to “The Big Shorts” data.

In The Big Shorts list, the nearly $2.4 billion short against MicroStrategy is the second-largest short held by a hedge fund against the company. The highest is a position worth over $3.58 billion.

However, retail investors continue to have faith in the future of stocks, as evidenced by Michael Sullivan’s reaction.

It’s official! I will buy some shares $RIOT!

I increased my holdings $ MSTR after Kerrisdale Capital started shorting it and I will now do the exact same thing for Riot. https://t.co/lJeIHNazRe pic.twitter.com/vBucH0mRPd

— Michael R. Sullivan (@SullyMichaelvan) June 5, 2024

In addition, MicroStrategy’s stock benchmark, Bitcoin, is expected to continue to rise in the market as central banks around the world cut key interest rates. Bitcoin regained the $70,000 mark this week. Some forecasts even predict that Bitcoin will reach $350,000 by August.

As far as I’m concerned, Microstrategy’s price action wasn’t a huge surprise.

When BTC goes up, MSTR outperforms BTC.

When BTC goes down, MSTR underperforms BTC.Just look at the relationship:

🠠 $BTCUSD

⚫️ MSTR/BTCBoth reached the bottom on the same day and climbed back up. pic.twitter.com/lqgCdQ1qUd

— Caleb Franzen (@CalebFranzen) May 20, 2024

Moral of the story: MicroStrategy is running on Bitcoin, but Wall Street is already preparing a wave of the apocalypse!

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent information. This article aims to provide accurate and relevant information. However, readers are encouraged to check the facts for themselves and seek professional advice before making any decisions based on this content.