Geographical exposure plays an important role in an investor’s portfolio. (Photo: 123RF)

More than a year ago, Morningstar released a report on investor preferences around the world. This report focused in particular on the way Canadians constructed their portfolios. In particular, one of the goals was to examine home bias, i.e. the excess of one’s own country’s stocks and bonds in relation to global indices, a situation that is not based on logical sound investing.

The “Home Bias in Canada” study focuses not only on individuals but also on retail funds managed by investment managers; in Canada it has already been shown that non-professionals prefer their country of origin. However, professional investors can look for favorable opportunities all over the world. They have far more resources than the individual investor and therefore should be immune to behavioral trends like home bias, right?

A review of more than 3,000 funds including equities, fixed income and balanced funds shows that the answer is not so clear-cut. As of September 2023, a significant portion of the funds held a disproportionate amount of Canadian products compared to the truly global alternative, which the report refers to as “benchmarks.” This means that investment managers, like individual investors, detect national bias in the funds they manage.

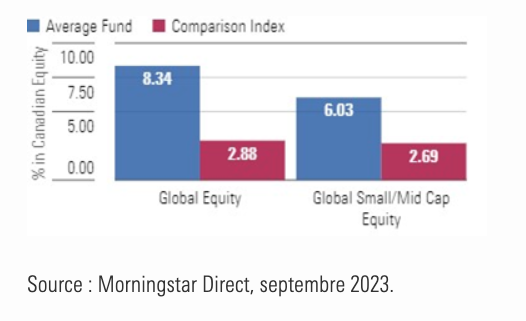

The study also found that this situation is much more common in funds of funds and balanced funds, two structures in which asset allocators and manager selectors can exert considerable influence over fund design. For example, global equity funds of funds had an average exposure to Canadian equities that was almost three times that of traditional global equity funds.

Canadian global equity funds hold significantly more local stocks

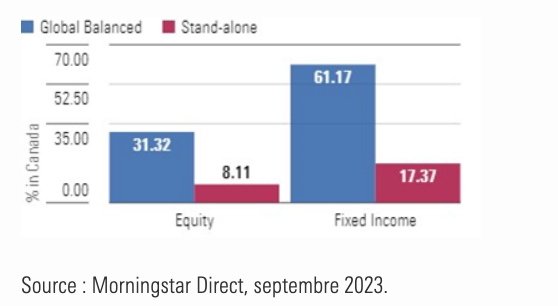

If we consider the average of global balanced funds, this disparity increases. Canadian equities are almost four times more weighted in global balanced funds than in the average global equity fund, after adjusting for allocation differences. Less than a tenth of global balanced funds hold a proportion of Canadian equities equal to or less than the Morningstar World Markets Index as a percentage of their equity exposure.

It’s the same story in fixed income, although it’s even rarer to find a global balanced fund without a country bias. About one in twenty funds hold less Canadian bonds than the Morningstar Global Core Bond Index as a percentage of its fixed-income exposure.

Which Balanced Funds Don’t Favor Canadian Bonds?

Those favoring Canadian stocks and neglecting global stocks have had an uphill battle over the past decade. A $10,000 investment in the Morningstar World Markets Index in September 2013 would have returned $7,500 more than the same investment in the Morningstar Canada Index in September 2023; Canada has fallen significantly short of the market over the past ten years.

Investing abroad paid off

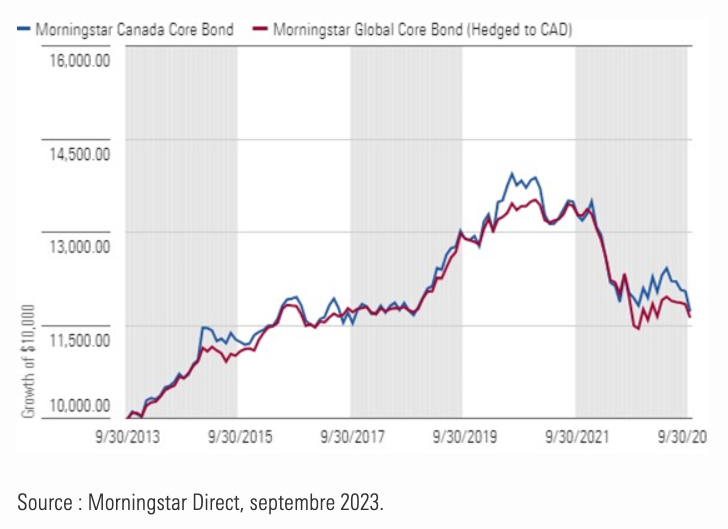

But while domestic bias has played an important role in equities, it doesn’t seem to matter as much in fixed income as non-Canadian bonds benefit from currency hedging. This condition is essential; many funds hedge their foreign currency exposure against Canadian dollars to eliminate the effect of the Canadian dollar’s movement against other currencies, but particularly against the US dollar. The report compares three indices: Morningstar Canada Core Bond, Morningstar Global Core Bond and Morningstar Global Core Bond (CAD Hedge) and shows the importance of hedging against currency risk in fixed income securities. For hedging, the returns are very similar. Without it, investors would have an unnecessarily bumpy ride.

Fixed income results are less affected by bias

Geographical exposure plays an important role in an investor’s portfolio. It seems that individual investors and investment managers are not completely immune to the phenomenon of home bias. This phenomenon is particularly important when it comes to equity strategies and portfolios: Canada has been fighting the world and the United States in particular for the last decade. Investors would do well to evaluate their biases and ensure that their decisions are not based on convenience but on sound reasoning.

Author: Michael Dobson