Last year, risk assets in the stock market (stocks and cryptocurrencies) achieved a double-digit percentage of bullish performance, and even a triple-digit percentage in the cryptocurrency market. Let’s take stock of the consensus of analysts and economists for 2024.

S&P 500 up 11% considered in 2024

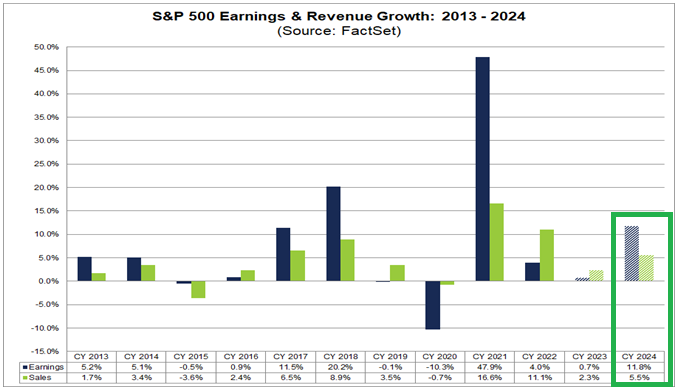

Despite the still-open debate about the likelihood of a US recession, earnings expectations for 2024 remain very bullish with an expected 11.7% annual growth and 5.5% turnover. The Fed’s key point, disinflation and a macroeconomic soft landing are the backdrop to such favorable expectations. Let’s summarize the latest expectations for the earnings of American companies this year.

This famous consensus of financial analysts and economists is most often wrong when compared to the actual facts found at the end of the year. Despite everything, it is he and his regular updates that drive the trend of the so-called “risky” assets in the financial markets, that is, the stock market and the cryptocurrency market in the final stage of risk.

Despite uncertainty about a U.S. economic recession this year, analysts expect the S&P 500 to post double-digit earnings growth in 2024. The estimated growth rate (annual rate) for 2024 is 11.7%, which is higher than the average earnings growth rate for the last 10 years of 8.4% (2013 – 2022).

Histogram setting out earnings and revenue expectations for S&P 500 companies for 2024

All eleven “super” sectors in the S&P 500 are expected to post year-over-year earnings growth in 2024. Five of these sectors are expected to see double-digit growth, led by healthcare, communication services and information technology, the latter two having a strong positive correlation with the price of Bitcoin.

XTB: a complete broker for investing

Finally, potential profits are expected to reach new all-time highs in 2024! Disinflation, a quick FED turnaround and a soft landing are the cornerstones, especially with resilience in household consumption (70% of US GDP).

In 2024, growth in the United States is expected to slow to 1.2% (but remain positive), in the UK to 0.4%, while growth in the Eurozone is expected to accelerate to 0.7%.

👉How to buy Bitcoins (BTC)? Find our step-by-step guide

US inflation could return to 2% as early as March 2024

Much of the expectation of double-digit earnings growth in 2024 is based on a scenario of a quick turnaround from the FED and ECB with significant rate cuts (between 4 and 6 over the period). ‘year). In short, how many rate cuts and at what speed?

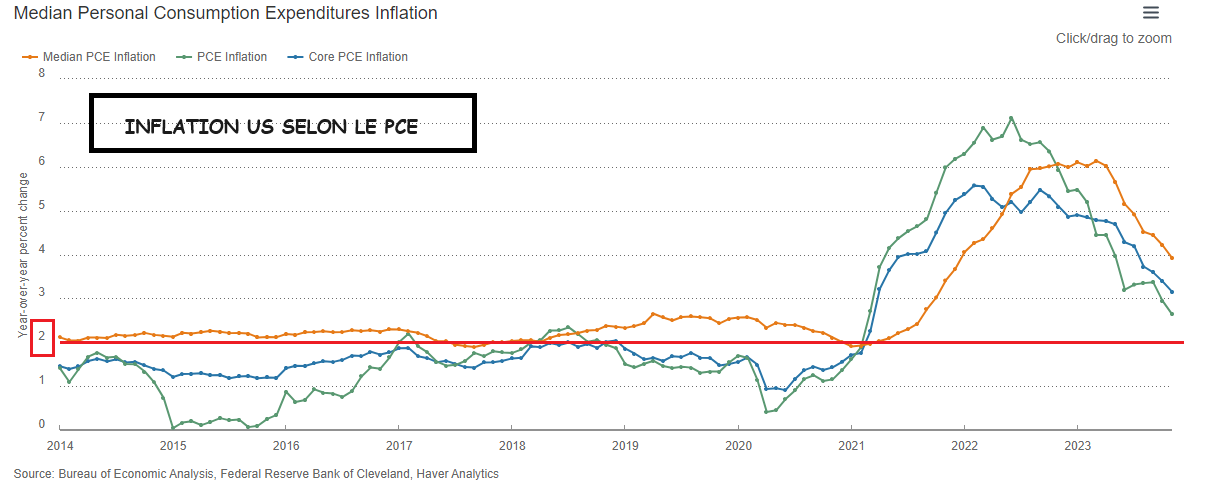

Remember that the cornerstone of such a monetary scenario is the confirmation of the inflation rate (nominal inflation + core inflation) returning to 2%.. The FED pays special attention to the PCE price index, whose last value fell to 2.6% in the nominal version and 3.2% in the basic version. The trajectory therefore remains bearish and close to the central bank’s target.

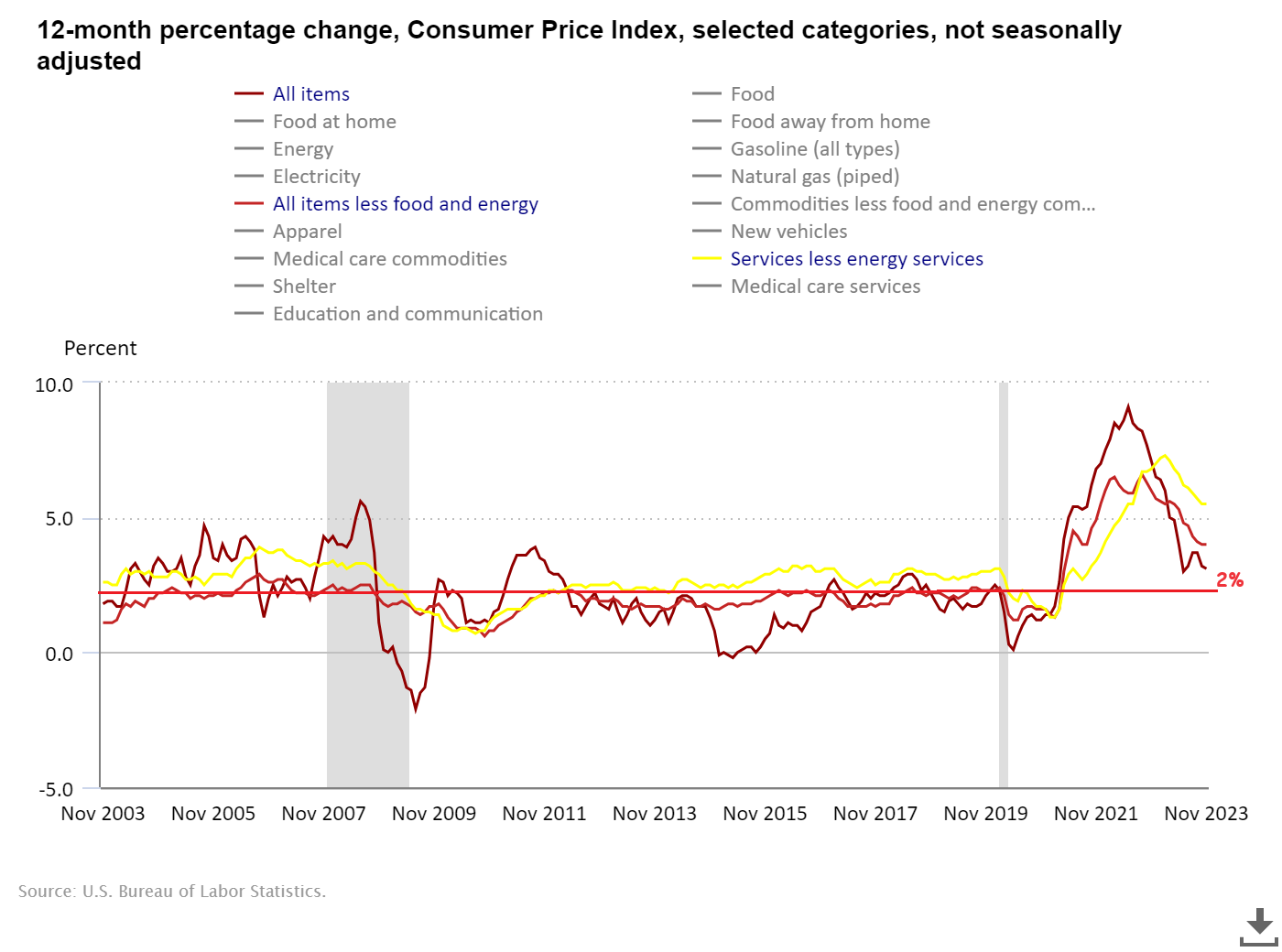

This Thursday, January 11th consumer price index CPI is updated for the month of December and core inflation should fall to 3.93%. Will US inflation be at 2% in March for the Fed to turn around? (this is one of the keys to the growth of profits and turnover of companies in 2024).

Inflation in the United States by CPI

Indeed, Truflation (based on blockchain technology) suggests that annual inflation is back in touch with 2%, essentially due to a favorable base effect. Inflation Nowcasting from the Cleveland Fed sees PCE falling to 2.30% in January. So there is reason to be optimistic about the fundamentals of traditional finance at the start of the year.

Inflation in the United States by PCE and CPI

To deepen your technical analysis, find me on the Cryptoast YouTube channel!

Find Technical Analysis by Vincent Ganne Cryptocurrency research, the perfect place to successfully invest in cryptocurrencies. You will learn how to position yourself at strategic price levels, find investment opportunities and predict price movements. Join us and take care of your crypto investments.

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This site may contain investment-related assets, products or services. Some links in this article may be affiliate. This means that if you purchase a product or register on a site from this article, our partner will pay us a commission. This allows us to continue to offer you original and useful content. Nothing will happen to you and you can even get a bonus using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this site and cannot be held responsible, directly or indirectly, for any damages or losses incurred after using the goods or services highlighted in this article. Investments related to cryptoassets are inherently risky, readers should do their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

recommendations of the AMF. There is no guaranteed high return, a product with high return potential involves high risk. This risk taking must be consistent with your project, your investment horizon and your ability to lose some of these savings. Do not invest unless you are prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notice pages.