Bitcoin will repeat its 2020 bull cycle

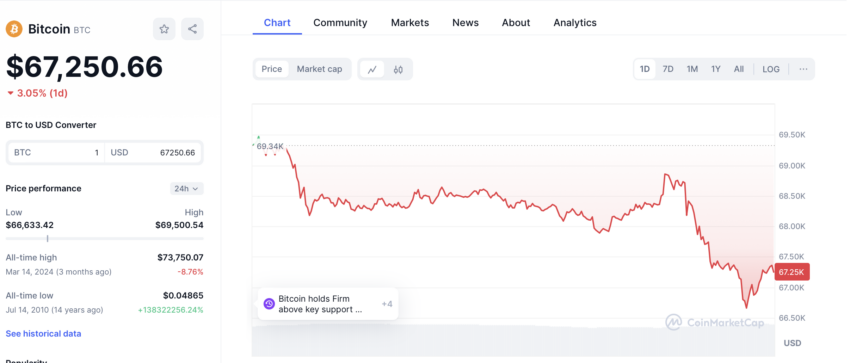

Bitcoin is currently trading at $67,334, down 2.60% in the last 24 hours and 8.76% from its March all-time high of $73,750. Many believed that with the approval of the Ethereum ETF, the Satoshi coin would reach a new all-time high after rising 13% in 48 hours.

However, it turns out that the cryptocurrency has not yet broken out of the corrective trend that lasted for almost two months.

Despite this, analysts remain optimistic about the future of Bitcoin. According to Ki Young Ju, CEO and founder of CryptoQuant, there is no need to fear BTC as the asset is repeating its pattern from 2020. In a post on X, he showed that the “Realized Cap for New Whales” experienced a similar development between 2020 and 2024.

Same atmosphere #Bitcoin like mid 2020.

Then, $BTC hovered around $10,000 for 6 months with high activity on the chain, later revealed as OTC trades.

Now, despite low price volatility, activity on the chains remains high, with $1 billion a day being added to new whale wallets, presumably for safekeeping. https://t.co/1TcC7BwNUb pic.twitter.com/o3N1AHxSJm

— Ki Young Ju (@ki_young_ju) May 31, 2024

To go further: BTC Prediction 2024/2025/2030

The “Realized Cap for New Whales” indicator measures the total value of Bitcoins held by new large investors based on their last transaction price. It thus enables monitoring the activity of new large holders, provides information on investor confidence and potential market movements.

Young-Ju observes a significant increase of around $1 billion per day in new whale wallets, indicating an increase in custodial activity rather than speculative trading. So these moves are very positive for the future of Bitcoin.

What are the price targets for BTC?

Although experts are optimistic about Bitcoin’s long-term future, feelings are rather mixed in the short term. In a post on

Quite a dull week in the markets for #Bitcoin as it continues to consolidate across key areas.

If $70,000 is not broken, then I expect $60,000 as a likely case in the coming months. pic.twitter.com/txzX0dwqjN

— Michaël van de Poppe (@CryptoMichNL) May 31, 2024

For his part, expert Rekt Capital focused more on the cyclicality of Bitcoin’s current performance. According to him, we are still far from the peak of the bull market, which should arrive in October 2025 if the asset repeats the same trajectory as during its previous bull cycles.

In the 2015-2017 cycle, Bitcoin peaked 518 days after the halving

In the 2019-2021 cycle, Bitcoin peaked 546 days after the halving

If history repeats itself and the next bull market top occurs 518-546 days after the halving…

This would mean that Bitcoin could peak in this cycle… pic.twitter.com/MeQnHg8Gwy

— Rekt Capital (@rektcapital) May 30, 2024

Moral of the story: Bitcoin is like a trampoline: the lower it goes, the higher it jumps!

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent information. This article aims to provide accurate and relevant information. However, readers are encouraged to check the facts for themselves and seek professional advice before making any decisions based on this content.