The cryptocurrency market has been quite restless since BTC hit a new all-time high of around $73,500 last March. Since then, many have wondered if the top of the market is near.

Celebrity-Approved Meme Horns: A Double-Edged Sword

A crypto investor known as “Gold” spoke on X about three signals that indicate a top in the cryptocurrency market:

- Celebrities started creating and supporting meme corners.

- Cryptocurrency and developers are creating millions of new meme coins.

- Social media was flooded with screenshots of the profit and loss figures.

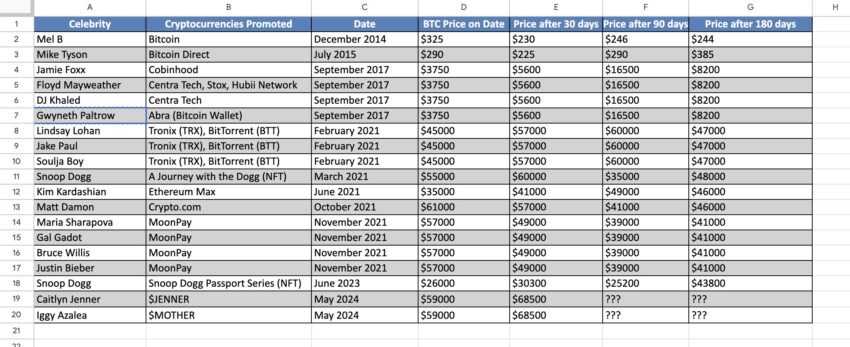

In fact, the crypto space has recently seen a notable increase in celebrity involvement, with figures like Caitlyn Jenner and Iggy Azalea launching their own meme coins. This star resurgence thus mirrors previous cycles where celebrity endorsements often preceded major market corrections.

Miles Deutscher, a renowned cryptoanalyst, discusses the subtle impact of this situation:

“Celebrities (love them or hate them) clearly attract one thing: attention. And that attention is proving critical to the health of the crypto economy. Since much of this attention is focused on the same corners, the industry is a major beneficiary. However, this comes with a trade-off because the focus is not always the same,” said Mr. Deutscher.

This trend raises questions about the real value celebrities add to the cryptocurrency ecosystem versus the potential for quick profits at the expense of ill-informed users. Indeed, historical data suggests that celebrity involvement in cryptocurrencies, while initially increasing market activity and coin liquidity, could also signal impending market caps, as seen in the 2017 and 2021 cycles.

“Based on this, we can conclude that when celebrities start promoting cryptocurrencies, the market usually experiences a final step up before reaching a local peak. Regardless, the sample size is small and thus the limit is limited. However, it is interesting,” said crypto influencer – Capo of Crypto.

Read more : How to detect crypto fraud?

Meme coin mania: a key indicator of market euphoria

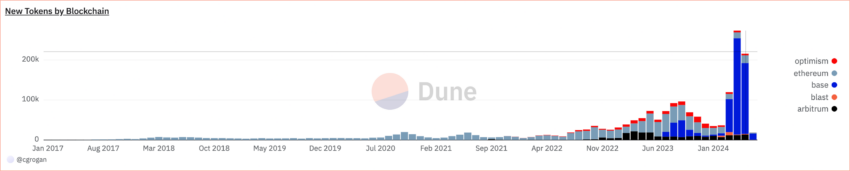

Additionally, an explosion of the same coins could be another red flag. The impressive surge in new meme coins, reported on the Dune dashboard by Coinbase CEO Conor Grogan, highlights the real mania surrounding these assets.

More than a million meme coins were created in the month of April alone, surpassing the total number of tokens created on the Ethereum blockchain since its inception. This peak reflects extreme market greed, a classic sign of a ceiling.

Many developers are really trying to make quick profits by creating meme coins. In addition, some nefarious actors also run “carpet pulling” scams through meme coin launches.

However, crypto investor Andrew Kang offers a different take on the situation, suggesting that meme coins now represent a mature sector that leads the market rather than following it. However, the general consensus remains this: this exponential growth in meme coin creation is a harbinger of a slowdown in the crypto market.

“The memecoin pump is no longer an indicator of local highs because memecoins no longer represent the bottom rung of desirability as an industry. This is actually the sector that new investors trust the most. The same coins have led and will lead the market,” Mr. Kang said.

“PnL” screenshops: A sign of overconfidence

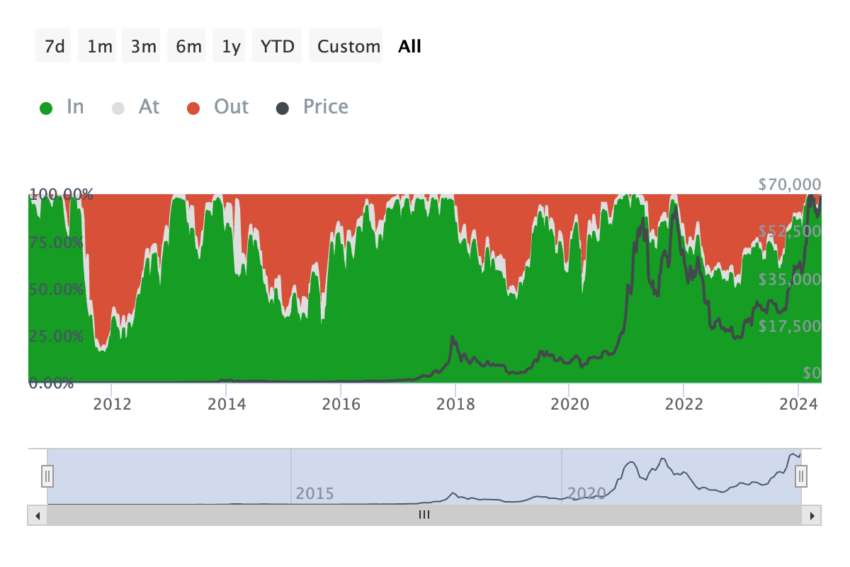

Finally, a third indicator of market capitalization is the prevalence of profit and loss, or “PnL” images on social media platforms, illustrating widespread profitability among traders. While this may seem positive, historically markets tend to reverse when this euphoria peaks.

Indeed, the ease with which it is possible to acquire assets during these periods often does not last, and the stunning display of gains could be the starting point of the coming crash of the crypto market.

For example, since the beginning of the year, more than 90% of Bitcoin investors are “in the money,” meaning they are in the green. Historically, the market has reversed after a long period of massive profitability.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, these three signals, the celebrity-backed meme coins, the proliferation of these crypto-tokens, and the public display of financial gains may not individually determine the behavior of the crypto market. However, their simultaneous occurrence should give pause to individual and institutional investors.

Indeed, past models have shown that celebrity involvement and “meme coin mania” correlate with periods of market peaks followed by sharp declines. The co-occurrence of these indicators could therefore help investors anticipate and potentially mitigate the risks associated with impending market capitalization.

However, Gold also notes that some significant bullish catalysts could invalidate market-top speculation. Therefore, investors should consider these nuances and make their investment decisions accordingly.

Moral of the story: Crypto when ceilings are scarier than floors.

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent information. This article aims to provide accurate and relevant information. However, readers are encouraged to check the facts for themselves and seek professional advice before making any decisions based on this content.