Posted on December 29, 2023 at 9:32 amUpdated on December 29, 2023 at 10:17 am

Green dominates the Paris stock market as it rises this Friday, the final session of a bumper year for stock markets that have more than resisted monetary tightening by central banks.

The Cac 40 gained 0.43% to 7,567.16 points around 10:25 am. The first session of 2023 on Monday 2 January kicked off a lavish year. Cac 40 gained 1.87% that day. Since then, the flagship index has posted an increase of almost 17% for the full year.

Wall Street closed almost flat on Thursday night. Its flagship S&P 500 has not dared to break its closing record, from which it is only about 13 points away. It is up 24.6% in 2023, the Dow Jones is up 13.8%, and in the box in another category, the Nasdaq Composite has jumped 44.2%, its best annual performance since 2003.

Despite concerns about inflation and rising interest rates, a small banking crisis in March and rising geopolitical tensions, the US economy and corporate earnings remained strong. The AI frenzy has fueled the technology world, dominated by the “Magnificent 7” like Nvidia. The celebratory atmosphere in recent months is also supported by the cessation of interest rate increases by central banks, which, according to the market, should turn into easing in the first or second quarter of 2024.

The arrangement of the planets in 2024 unlikely

But can the US central bank meet the high expectations of the market, which is counting on six rate cuts next year, without being twisted by the economic recession? ” For the markets to continue to grow, alignment of the planets is necessary, which is highly unlikely », Judge Vincent Mortier of Amundi, quoted by the Financial Times. If the Fed loosens policy early in the year, “ will make a serious mistake” according to him. “Assume inflation is no longer a problem (…) can lead to repeating past mistakes “.

Ipek Ozkardeskaya, an analyst at Swissquote, notes that the S&P 500 tends to rise after the initial rate cut, but that the sustainability of gains depends on economic fundamentals. ” Falling US yields will support S&P 500 valuations if the economy remains strong and earnings expectations hold. That’s it for now. Earnings per share are expected to grow by more than 10% in 2024 and around 22% for the “Magnificent 7”. But it’s worth noting that these forecasts are largely factored in, so yes, there will still be a hangover and a correction period after a two-month uninterrupted rally that has fueled widespread risk-asset euphoria among investors. », emphasizes Ipek Ozkardeskaya.

Japan shines and China remains in the shadows

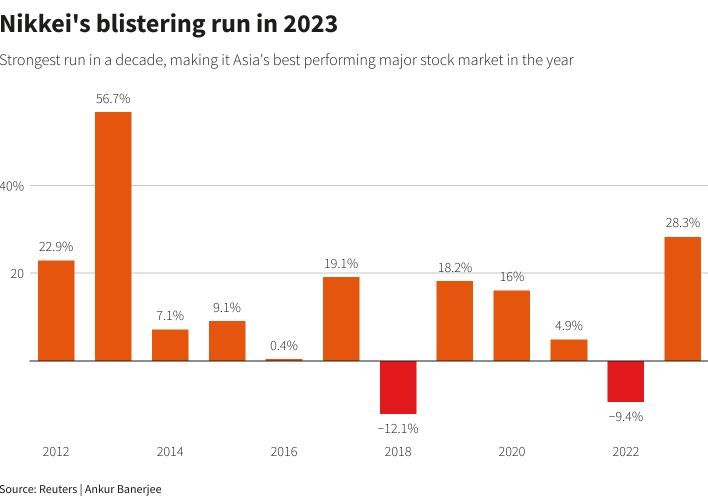

In Asia, the Nikkei posted the region’s biggest annual gain, climbing 28%, the first for the Japanese index since 2013, when Haruhiko Kuroda took over as Bank of Japan governor and began easing.

Conversely, the CSI of the Shanghai and Shenzhen stock exchanges fell 11.4% in 2023, the third consecutive year of decline, on the back of a slow economic recovery after Covid. This Friday, the index strengthened by 0.5%.

On the business side, French luxury giants feature in the Cac 40 this Friday: LVMH, Kering and Hermès rose between 0.7% and 0.8%.

If LVMH and Hermès have reached a higher level during the year, neither of them is among the big winners within the Cac 40. The biggest progress this year has been made by carmaker Stellantis.

Medtech Carmat is up 8.8% after announcing software improvements that will boost the safety profile of the Aeson artificial heart it designs, manufactures and markets for heart transplants.